The new VAT rates VAT rates

Reminder of the situation

In the popular vote of September 24th, 2017 the sovereign rejected the Federal Decree of March 17th, 2017 on additional financing of the AHV through an increase in value-added tax, as well as the Federal Law of March 17th, 2017 on the 2020 pension reform. For this reason, VAT rates will change on January 1st, 2018.

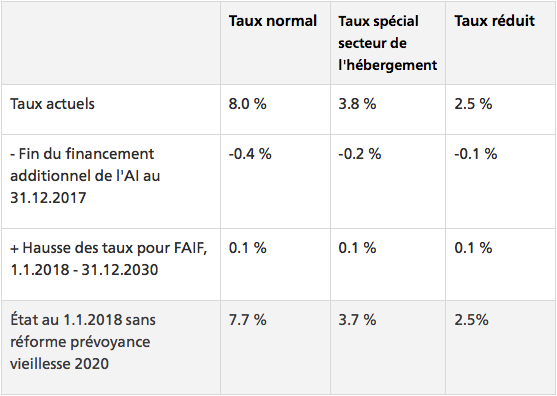

VAT rates are laid down in the Swiss Constitution (arts. 130 and 196, ch. 14 Cst.). Consequently, any change in rates must be approved in a referendum by the people and the cantons. Since 2011, the standard rate has been 8%, the special rate for accommodation services 3.8% and the reduced rate 2.5%. Part of the VAT revenue (0.4 percentage points of the standard rate, 0.2 percentage points of the special rate and 0.1 percentage points of the reduced rate) is used for the additional financing of the IV, which ends in December 2017. As a result of the rejection of the additional financing, VAT rates will fall on January 1, 2018. As a result, net tax rates will also be adjusted.

However, in the popular vote of February 9th, 2014, the people and cantons accepted a 0.1 percentage point increase in the three VAT rates on January 1st, 2018, in favor of the financing and development of rail infrastructure (FAIF).

The table above provides a summary of the rates concerned.

We will not give up on you

So that you can start 2018 with peace of mind, we’ll help you update your IT management solution. Microsoft Dynamics NAV.

We will contact you in the first week of November to plan the rate change.

Comments are closed.