Agicap

The European leader in cash management for mid-market companies

Agicap will revolutionise your cash flow

Agicap’s mission is to provide managers and finance teams with an intuitive SaaS solution that maximises the automation of their cash management. With Agicap, you can easily centralise your financial data, anticipate cash flows and make strategic decisions with complete confidence.

Today, Agicap supports more than 8,000 customers in 12 European countries, helping them to better manage their daily cash flow. With functionalities designed to simplify financial analysis, Agicap is transforming the way companies plan and control their financial future and is registered as a Partner Dematerialisation Platform (PDP) by the French government.

Why choose Agicap ?

Agicap aims to act at an operational, strategic and financial level to add value to financial and management teams in managing their cash

Saving time, reducing the risk of errors, making cash flow forecasts more reliable, reducing financial costs, anticipating investments, controlling the risk of cash shortages… these are just some of the challenges for which Agicap’s cash management solution offers a unique, collaborative and user-friendly management interface, with a host of features to facilitate the daily work of teams.

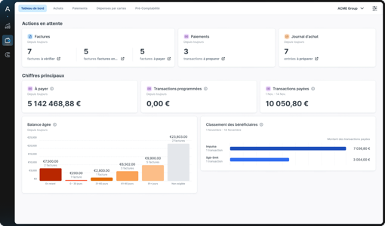

Manage your cash with one all-in-one tool

Agicap integrates cash flow monitoring, budget forecasting and supplier and customer invoice management on a single platform. As a result, you avoid having to use several heterogeneous tools and benefit from accurate monitoring, highly reliable forecasts and systematic optimisation of your cash flow.

Increase productivity

The bank connection and automation offered by Agicap (synchronisation of bank flows, automated customer reminders and supplier payments) drastically reduce manual tasks. You can increase the reliability of your data and save valuable time on a daily basis by analysing figures instead of entering them. You can also save time on data processing thanks to the automatic integration and updating of your financial data from various sources (banks, ERP, Excel, etc.).

Get instant consolidated visibility

Agicap gives you a consolidated, real-time view of the company’s liquidity, even if it is spread across numerous bank accounts or subsidiaries. Blind spots are eliminated, giving finance departments total control over cash and enabling them to make informed decisions.

Collaborate effectively

An all-in-one modular platform dedicated to cash management.

A cash management module

Cash Management: Connect, forecast and optimise your cash flows on a single platform.

Key features :

- Short-term cash management

- Multi-source cash flow forecasting

- Investment management

- Debt management

- Factoring management

- Reporting and analysis

How you benefit: Make informed decisions to improve cash performance with reliable, automated data

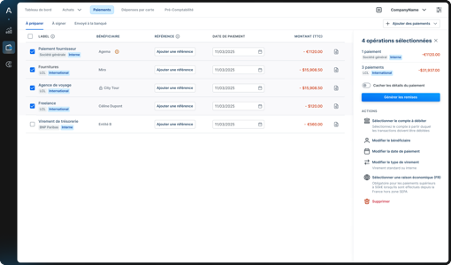

A payments module

Agicap’s Payment Factory connects to your banks and ERP systems to automate and secure all your payments.

Key features :

- Payment logs

- Beneficiary management

- Validation workflow

Your gain: centralise your payments on a single interface and secure your payment processes

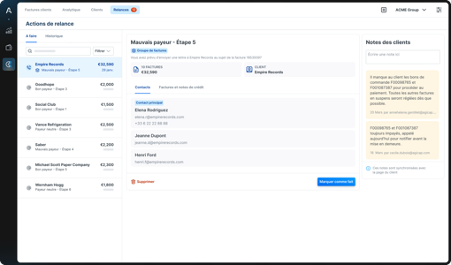

A client workstation management module

Receivables management: Agicap automates customer reminders to improve debt collection and monitoring.

Key features :

- DSO Monitoring

- Collection Management

- Factoring Management

- Accounting Automation

Your benefits: reduction of manual tasks, centralisation of all your customer interactions in a single interface and customer risk analysis.

An expense management module

Expense management: Track, optimise and accelerate the management of your supplier base

- Budget management

- Purchase orders and deliveries

- Dematerialisation of invoices

- Accounting automation

- Corporate cards and expense reports

Your benefit: Cost reduction and control over your entire purchasing process

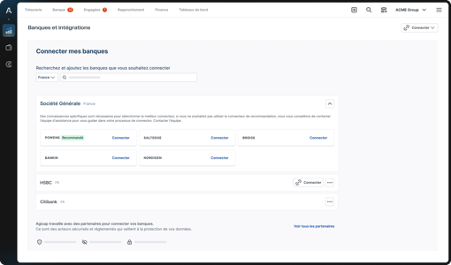

A connectivity module

Connectivity: Agicap integrates all your banks, ERP and business tools in a single interface.

Key features :

- Connection to your bank data

- Execution of your payments, recovery of your pending transactions

- Sending of your bank, purchase and sales journals, etc.

Your benefit: centralise your bank statements, make payments from all your banks in all your currencies and integrate your ERP data bi-directionally via API or SFTP.